Safeguarding Success: Bagley Risk Management Services

Wiki Article

Understanding Animals Danger Security (LRP) Insurance Policy: A Comprehensive Overview

Browsing the world of animals risk defense (LRP) insurance policy can be an intricate endeavor for lots of in the farming sector. This sort of insurance policy supplies a security net versus market variations and unanticipated scenarios that could influence livestock producers. By recognizing the ins and outs of LRP insurance coverage, producers can make enlightened decisions that may guard their operations from financial threats. From just how LRP insurance coverage works to the different insurance coverage options available, there is much to discover in this comprehensive overview that could possibly form the means livestock manufacturers approach danger management in their companies.

Just How LRP Insurance Coverage Functions

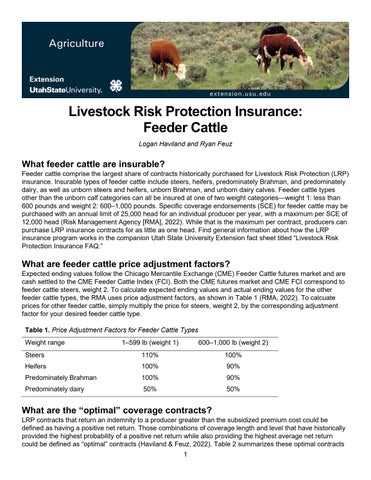

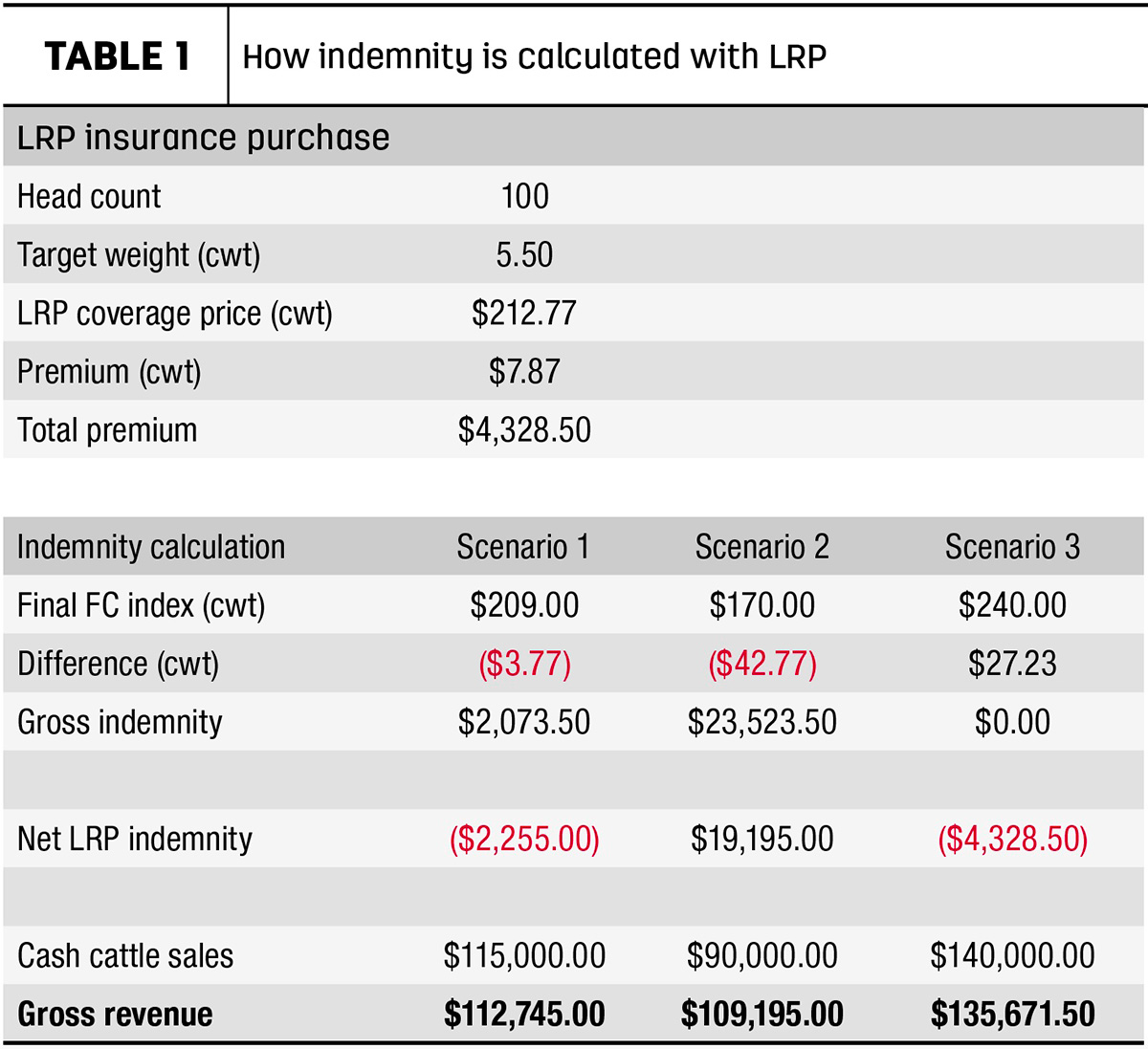

Occasionally, understanding the technicians of Animals Danger Security (LRP) insurance coverage can be intricate, but breaking down just how it functions can supply clarity for breeders and farmers. LRP insurance coverage is a threat monitoring device developed to secure livestock manufacturers against unforeseen rate declines. It's crucial to note that LRP insurance policy is not an income warranty; rather, it focuses exclusively on price risk protection.Qualification and Insurance Coverage Options

When it comes to insurance coverage choices, LRP insurance supplies manufacturers the flexibility to pick the coverage level, insurance coverage duration, and endorsements that best suit their danger monitoring demands. By comprehending the eligibility requirements and insurance coverage options available, animals producers can make enlightened decisions to manage risk successfully.

Advantages And Disadvantages of LRP Insurance

When reviewing Animals Danger Protection (LRP) insurance policy, it is vital for animals producers to evaluate the advantages and downsides integral in this threat management tool.

One of the key benefits of LRP insurance is its capacity to offer protection versus a decrease in livestock prices. Furthermore, LRP insurance policy provides a level of flexibility, permitting manufacturers to tailor protection levels and policy durations to fit their specific needs.

Nonetheless, there are likewise some downsides to consider. One limitation of LRP insurance coverage is that it does not secure versus all kinds of threats, such as illness episodes or natural disasters. Costs can occasionally be expensive, particularly for producers with large animals herds. It is essential for manufacturers to thoroughly examine their specific danger direct exposure and economic circumstance to figure out if LRP insurance coverage is the appropriate danger management device for their operation.

Comprehending LRP Insurance Coverage Premiums

Tips for Making The Most Of LRP Advantages

Making best use of the advantages of Livestock Danger Defense (LRP) insurance requires strategic preparation and proactive danger administration - Bagley Risk Management. To maximize your LRP coverage, think about the following ideas:On A Regular Basis Analyze Market Problems: Remain notified about market patterns and rate fluctuations in the animals sector. By keeping an eye on these aspects, you can make informed decisions about when to buy LRP coverage to protect against possible losses.

Set Realistic Coverage Levels: When selecting protection degrees, consider your manufacturing expenses, market price of animals, and possible threats - Bagley Risk Management. Establishing sensible coverage levels guarantees that you are sufficiently safeguarded without overpaying for unnecessary insurance

Diversify Your Insurance Coverage: As opposed to depending entirely on LRP insurance policy, think about expanding your danger management approaches. Integrating LRP with other risk monitoring tools such as futures agreements or options can offer thorough insurance coverage versus market unpredictabilities.

Review and Change Coverage On a regular basis: As market problems change, occasionally assess your LRP coverage to ensure it lines up with your present threat direct exposure. Readjusting coverage degrees and timing of purchases can assist enhance your threat defense approach. By following these pointers, you can take full advantage of the advantages of LRP insurance and guard your livestock procedure against unexpected risks.

Conclusion

To conclude, livestock risk security (LRP) insurance coverage is a useful tool for farmers to manage the economic threats linked with their animals operations. By understanding exactly how LRP functions, qualification and coverage options, as well as the advantages and disadvantages of this insurance coverage, farmers can make click reference informed choices to safeguard their incomes. By thoroughly considering LRP costs and carrying out techniques to take full advantage of advantages, farmers can minimize possible losses and make certain the sustainability of their procedures.

Livestock manufacturers interested in obtaining Livestock Risk Defense (LRP) insurance can discover a range of qualification requirements and protection choices customized to their certain animals operations.When it comes to coverage choices, LRP insurance coverage supplies manufacturers the adaptability to select the protection degree, insurance coverage period, and recommendations that ideal match their threat monitoring demands.To comprehend the intricacies of Livestock Threat Defense (LRP) insurance coverage completely, comprehending the aspects affecting LRP insurance policy costs is critical. LRP insurance policy costs are determined by various components, including the coverage degree selected, the expected price of animals at the end of the insurance coverage period, the type of livestock being insured, and the size of the protection period.Evaluation and website link Adjust Protection On a regular basis: As market conditions transform, occasionally assess your LRP coverage to ensure it aligns with your existing threat direct exposure.

Report this wiki page